Forex, short for foreign exchange, refers to the decentralized global market where currencies are bought and sold. It is

the largest financial market in the world, with trillions of dollars traded daily. Forex trading involves the

speculation on the price movements of various currency pairs, with the aim of making profits from these fluctuations.

Understanding what is forex and how it works is essential for anyone interested in participating in the forex market.

How Does Forex Trading Work?

Forex trading involves the buying and selling of currency pairs. The forex market operates 24 hours a day, five days a

week, allowing traders to engage in trading activities at any time. Here are the key components and concepts involved

in forex trading:

- Currency Pairs: In forex trading, currencies are always traded in pairs. The first currency in the pair is called the

base currency, while the second currency is known as the quote currency. For example, in the EUR/USD pair, the euro

is the base currency, and the US dollar is the quote currency. - Exchange Rate: The exchange rate represents the value of one currency in relation to another. It indicates how much

of the quote currency is needed to buy one unit of the base currency. Exchange rates are constantly fluctuating due

to various factors such as economic indicators, geopolitical events, and market sentiment. - Bid and Ask Price: The bid price is the price at which traders can sell the base currency, while the ask price is

the price at which traders can buy the base currency. The difference between the bid and ask price is known as the

spread, which represents the transaction cost in forex trading. - Leverage and Margin: Forex trading often involves the use of leverage, which allows traders to control larger

positions with a smaller amount of capital. Margin is the amount of money required by the broker as collateral to

open and maintain a trading position. Leverage amplifies both potential profits and losses in forex trading.

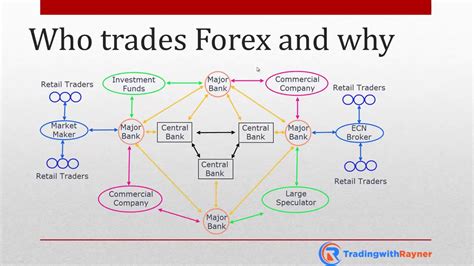

Participants in the Forex Market

The forex market is composed of various participants who engage in currency trading. Understanding the roles of these

participants is essential in grasping the dynamics of the forex market. Here are the main participants:

1. Banks and Financial Institutions

Banks play a crucial role in the forex market as they facilitate currency transactions for their clients. They provide

liquidity by buying and selling currencies, both for speculative purposes and to meet the needs of their clients,

including businesses and individuals.

2. Central Banks

Central banks, such as the Federal Reserve (Fed) in the United States or the European Central Bank (ECB), play a vital

role in the forex market. They are responsible for implementing monetary policies, controlling interest rates, and

managing their country’s currency reserves. Central banks often intervene in the forex market to stabilize their

currency or manage economic conditions.

3. Corporations and Businesses

Corporations and businesses participate in the forex market to conduct international trade and manage foreign currency

risks. They engage in currency transactions to convert one currency into another when buying or selling goods and

services across borders.

4. Individual Traders

Individual traders, including retail traders, speculators, and investors, make up a significant portion of the forex

market. With the advancement of technology, individual traders can access the forex market through online brokers and

trading platforms. They aim to profit from the price movements of currency pairs by buying low and selling high or vice

versa.

Advantages and Risks of Forex Trading

Advantages of Forex Trading

- Liquidity: The forex market is highly liquid, meaning that traders can easily enter and exit positions at any time,

even with large volumes. - 24/5 Market: The forex market operates 24 hours a day, five days a week, allowing traders to participate at their

convenience. - Opportunity for Profit: The forex market’s volatility creates opportunities for traders to profit from price

fluctuations. - Wide Range of Trading Instruments: Traders can choose from various currency pairs and take advantage of

opportunities in different markets around the world.

Risks of Forex Trading

- Market Volatility: The forex market can be highly volatile, and price movements can be rapid and unpredictable.

- Leverage Risks: While leverage can amplify profits, it can also magnify losses if not used responsibly.

- Market Manipulation: Due to the decentralized nature of the forex market, there is a risk of market manipulation by

large players or unethical practices. - Overtrading and Emotional Decision-Making: Traders may be tempted to trade excessively or make impulsive decisions

based on emotions, leading to poor trading outcomes.

Conclusion

Forex, the foreign exchange market, is a decentralized global market where currencies are bought and sold. It is a dynamic and highly liquid market that operates 24/5. Forex trading involves speculating on the price movements of currency pairs to make profits. Understanding the basics of forex trading, including currency pairs, exchange rates, bid and ask prices, and leverage, is essential for anyone looking to participate in this market.

The forex market is comprised of various participants, including banks, central banks, corporations, businesses, and individual traders. Each participant plays a unique role and contributes to the overall liquidity and dynamics of the market.

Forex trading offers several advantages, such as high liquidity, flexible trading hours, profit opportunities, and a wide range of trading instruments. However, it also carries risks, including market volatility, leverage risks, market manipulation, and the potential for emotional decision-making.

To succeed in forex trading, it is important to have a solid understanding of market dynamics, develop a trading strategy, and practice proper risk management. Continuous learning and staying informed about economic and geopolitical events that can impact currency movements are also crucial.

In conclusion, forex trading offers exciting opportunities for traders to profit from the fluctuations in currency prices. However, it is important to approach forex trading with caution, proper knowledge, and risk management strategies. By staying informed, continuously learning, and developing effective trading strategies, traders can navigate the forex market with confidence and increase their chances of success.

Suggestion for Beginners in Forex Trading

If you are new to forex trading, here are some suggestions to get started:

- Learn the Basics: Take the time to understand the fundamentals of forex trading, including terminology, concepts, and

trading mechanics. Familiarize yourself with different trading strategies and risk management techniques. - Practice with a Demo Account: Open a demo account with a reputable forex broker and practice trading with virtual

money. This allows you to gain hands-on experience without risking real capital. - Start with Small Positions: When you transition to a live trading account, start with small position sizes. This

allows you to manage risk effectively and gain confidence as you learn the ropes of real trading. - Keep Learning: Forex trading is a continuous learning process. Stay updated with market news, economic indicators, and

trading analysis. Expand your knowledge and refine your trading strategies. - Manage Your Emotions: Emotions can have a significant impact on trading decisions. Learn to control your emotions,

avoid impulsive trades, and stick to your trading plan.