In the world of forex trading, daily forex analysis and predictions are crucial tools for traders to make informed decisions about their trades. In the first two paragraphs, we will explore how daily forex analysis and predictions are used to understand the market and their significance in navigating the dynamic currency market.

Understanding Daily Forex Analysis and Predictions

Daily forex analysis and predictions involve studying the currency market on a daily basis to analyze market trends, identify potential trading opportunities, and make prediction about the future movements of currency pairs. Traders and analysts use various techniques, including technical analysis, fundamental analysis.

The Significance of Daily Analysis and Predictions

Market Understanding and Context

Daily analysis and predictions provide traders with a deeper understanding of the market dynamics and context. By analyzing market trends, price patterns, and economic indicators, traders can gain insights into the overall market sentiment and identify potential trading opportunities.

Identification of Trading Setups

Daily analysis helps traders identify trading setups and potential entry and exit points. By studying charts, technical indicators, and support and resistance levels, traders can spot patterns and trends that indicate favorable trading conditions.

Risk Assessment and Management

Daily analysis and predictions assist traders in assessing and managing risks effectively. By analyzing market volatility, economic news releases, and geopolitical events, traders can adjust their risk management strategies and position sizes to align with market conditions.

Methods for Daily Forex Analysis and Predictions

Technical Analysis

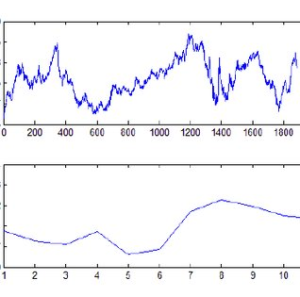

Technical analysis involves analyzing historical price data, chart patterns, and technical indicators to predict future price movements. Traders use tools like moving averages, trendlines, and oscillators to identify potential trading opportunities.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, central bank policies, and geopolitical events to assess the intrinsic value of currencies. Traders analyze factors such as GDP reports, interest rate decisions, employment data, and political developments to make predictions about currency movements.

Sentiment Analysis

Sentiment analysis involves evaluating market sentiment and investor psychology to gauge the overall market mood. Traders assess factors such as news sentiment, market sentiment indicators, and social media trends to identify potential shifts in market sentiment and sentiment-driven trading opportunities.

Conclusion and Suggestions

Daily forex analysis and predictions are powerful tools that can provide traders with valuable insights and enhance their decision-making process. Here are some concluding thoughts and suggestions when using daily analysis and predictions:

- Stay Updated: Keep yourself informed about the latest market news, economic indicators, and geopolitical events that can impact currency movements. Regularly review daily forex analysis reports and stay updated with market trends.

- Combine Multiple Perspectives: Consider incorporating multiple methods of analysis, such as technical, fundamental, and sentiment analysis, to gain a well-rounded understanding of the market. Each method provides unique insights and can complement each other in making informed trading decisions.

- Focus on Risk Management: Always prioritize risk management in your trading activities. Set appropriate stop-loss orders, manage position sizes based on your risk tolerance, and avoid overexposing yourself to high-risk trades. Protecting your capital should be a top priority.

- Track Your Results: Keep a trading journal to track the outcomes of your trades based on the daily forex analysis and predictions you follow. This will help you evaluate the effectiveness of your strategies over time and make necessary adjustments for improvement.

- Continuous Learning: Forex markets are dynamic, and there is always more to learn. Invest time in expanding your knowledge through educational resources, books, webinars, and engaging with the trading community. Stay curious and open-minded to new strategies and techniques.